Minnesota’s Fraud Crackdown: How a COVID Food Scandal Became a Test of Financial Surveillance and Immigration Politics

Sarah Johnson

December 13, 2025

Brief

Treasury’s Minnesota fraud crackdown goes far beyond COVID-era graft. This analysis unpacks the clash of financial surveillance, Somali diaspora remittances, and partisan immigration politics driving the investigation.

Behind the Minnesota Fraud Crackdown: Money Laundering, Migration Politics, and a Test of Federal Power

The Treasury Department’s decision to deploy personnel to Minnesota and impose a geographic targeting order (GTO) on money services businesses (MSBs) is far more than a routine fraud probe. It is a stress test of how the U.S. handles pandemic-era corruption, diaspora remittances, and racially charged politics in one of the country’s most significant refugee communities.

On the surface, this looks like a follow-up to the Feeding Our Future scandal — a massive COVID-era nutrition fraud case already described by federal prosecutors as the largest of its kind in the nation. Underneath, it is about the architecture of U.S. financial surveillance, the politicization of immigrant communities, and whether Washington can crack down on real crimes without criminalizing the legitimate flow of money and people.

The bigger picture: How a food program scandal morphed into a financial crime test case

The Minnesota scandal began in a familiar place: a federal program designed to feed vulnerable children under the USDA’s Child and Adult Care Food Program and Summer Food Service Program. During the pandemic, emergency waivers loosened documentation rules and allowed sponsors to rapidly expand meal sites. A nonprofit, Feeding Our Future, allegedly exploited those relaxed controls, creating hundreds of sham meal locations and claiming to serve millions of meals that never existed. Prosecutors say as much as $250 million was siphoned off; local Republicans argue the total fraud across similar nonprofits may reach $2 billion.

Historically, large-scale program fraud has often ended at the indictment stage, with some clawbacks and a few reforms: think of Medicare billing scams in the 1990s or post-Katrina disaster aid fraud. What’s different here is the next step. Treasury Secretary Scott Bessent is weaponizing one of the department’s most potent tools — the GTO — and applying it to MSBs in Minnesota, with explicit focus on funds flowing to “areas of concern, such as Somalia.”

This shifts the frame from domestic grant abuse to international money laundering and terror financing risk. Treasury is effectively saying: the scandal isn’t just about people lying on forms; it’s about possible abuse of the broader financial system, including remittance corridors heavily used by Somali Americans.

What this really means: Remittances, Somali diasporas, and financial de-risking

Somali communities in the U.S. rely heavily on MSBs and hawala-style remittance networks to send money back home. The World Bank has estimated that remittances make up a substantial share of Somalia’s economy — often cited in the 20–30% of GDP range — and the U.S. Somali diaspora is a key contributor. Formal banking channels to Somalia have long been fragile due to anti-money-laundering (AML) and counter-terrorism financing concerns, leading many mainstream banks to close accounts of remittance companies in the mid-2010s.

The Minnesota crackdown sits squarely in that history of “de-risking,” where banks and regulators respond to perceived risk by withdrawing services altogether, rather than surgically targeting bad actors. When a GTO is placed on MSBs in a region tied to a specific diaspora, two things can happen:

- Investigators gain a richer data stream to identify suspicious transfers and networks, potentially revealing sophisticated laundering routes.

- Legitimate remittances get swept into a dragnet, increasing costs and delays, and incentivizing a shift back to informal, less trackable channels.

That dual effect is the central policy dilemma. The Minnesota move signals that Treasury is willing to absorb the political cost of heightened scrutiny on a specific immigrant community’s financial lifeline in order to pursue what it sees as systemic fraud.

The political economy: COVID aid, red state–blue state narratives, and scapegoating risk

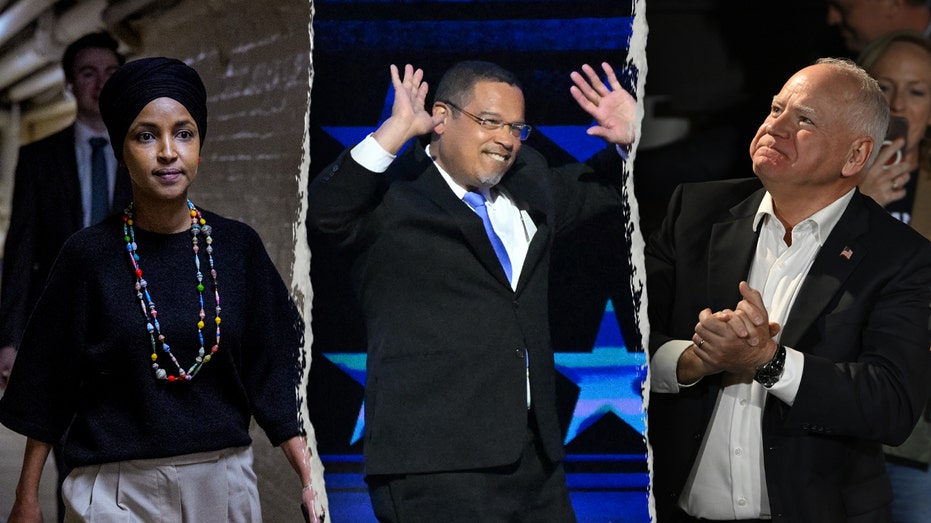

The investigation is not occurring in a vacuum. Minnesota is a Democratic-led state, with Gov. Tim Walz and Rep. Ilhan Omar already prominent political targets for Republicans. Bessent’s language about “feckless mismanagement” under Walz dovetails with a larger national narrative: that blue states mismanaged pandemic relief and fostered bloated, corrupt welfare systems.

At the same time, former President Donald Trump has escalated the rhetoric, describing “Somali gangs” and calling for mass deportations, framing the fraud scandal as proof that immigration — particularly refugee resettlement — carries hidden costs. Minnesota Democrats have pushed back, emphasizing that those who committed crimes should face prison, but that demonizing an entire ethnic group undermines both public safety and social cohesion. Walz’s stance reflects a tension that many state leaders face: insistence on accountability without feeding xenophobic narratives.

Historically, episodes of major fraud linked to specific ethnic or migrant communities — from early 20th century Italian-American organized crime stereotypes to 1990s welfare fraud tropes aimed at Black communities — have been used to justify broad, often punitive policies. The Minnesota case risks being instrumentalized similarly: not merely to reform oversight, but to argue against refugee resettlement and multiculturalism more broadly.

How the GTO and on-the-ground Treasury deployment changes the game

Geographic targeting orders are rare and consequential. Past GTOs have focused on high-end real estate in cities like Miami and New York, requiring title insurers to report all-cash purchases by shell companies in order to crack down on money laundering. Another strand of GTOs has targeted cross-border cash couriers or specific trade hubs known for smuggling.

Applying a GTO to MSBs in Minnesota does several things:

- Normalizes high-intensity surveillance in domestic social-program scandals. What began as a food program fraud investigation is now treated with tools typically reserved for terrorist financing, drug cartels, or oligarch wealth laundering.

- Creates a real-time pipeline to FinCEN. MSBs will be compelled to file detailed reports on certain transactions, which will be integrated into FinCEN databases and shared with law enforcement. That expands the analytical reach beyond Minnesota, potentially exposing networks in other states like Ohio, where whistleblowers claim similar schemes operate.

- Signals scrutiny of MSBs as a sector. By announcing that IRS will examine these businesses and that FinCEN will issue formal Notices of Investigation, Treasury is pushing MSBs to invest in compliance infrastructure often beyond their current capacity.

For small, community-based MSBs, especially those serving refugee communities, compliance costs and fear of missteps may drive consolidation or closure. That, in turn, may funnel more remittance flows through a smaller number of larger providers, increasing concentration risk.

What mainstream coverage is missing

Most accounts frame this story as a clean morality play: corrupt nonprofits, negligent state overseers, and a federal government finally cracking down. Several deeper issues are largely overlooked:

- The structural design flaws in emergency aid programs. The pandemic-era waivers that made fraud easier were bipartisan decisions designed to speed up aid. There has been relatively little serious analysis of how to build “resilient oversight” that can flex in emergencies without creating a free-for-all.

- The risk of creating parallel legal standards. If fraud in a community heavily associated with refugees is responded to with terrorism-adjacent tools like GTOs and targeted scrutiny of remittances, while similar levels of fraud in other contexts (e.g., PPP loan fraud in more affluent, non-immigrant communities) receive less aggressive financial surveillance, the system risks being perceived as ethnically selective.

- The international-security feedback loop. If legitimate remittances are choked off, the resulting economic strain in Somalia could worsen instability — the very condition that drives migration and security concerns in the first place.

Expert perspectives

Financial crime and migration experts warn that the U.S. is walking a fine line.

Many AML specialists point to the post-9/11 era, when Somali and other Muslim communities saw bank accounts closed en masse. That episode forced regulators to reconsider the blunt application of risk rules. The Minnesota case is a test of whether those lessons have truly been absorbed or whether the system defaults again to broad, community-level suspicion.

Refugee and diaspora scholars also stress that while some fraudsters may exploit community ties to move money, those same networks are the backbone of integration and transnational support. Policies that paint with too broad a brush may fracture trust not only in law enforcement but in public institutions more broadly.

Data and evidence: Fraud, remittances, and oversight gaps

Several data points frame what is at stake:

- COVID program fraud scale: The U.S. Secret Service has previously estimated that nearly $100 billion in pandemic relief funds may have been stolen nationwide across various programs. The Minnesota food program fraud is a prominent case within a broad national pattern.

- Somali population in Minnesota: Estimates place Minnesota’s Somali population at around 80,000–100,000, one of the largest Somali communities outside Africa. This concentration naturally leads to clustering of MSBs that specialize in Somalia remittances.

- Remittance dependency: World Bank data show Somalia as among the most remittance-dependent countries globally. Even modest disruptions in U.S. remittance channels can translate into significant household-level consequences abroad.

- Enforcement unevenness: Federal watchdogs have flagged billions in improper payments in programs like Medicaid and unemployment insurance annually, yet there has been no comparable use of GTOs in those sectors. That asymmetry is likely to become a political flashpoint.

Looking ahead: Scenarios to watch

Several concrete developments will determine whether this becomes a model of targeted enforcement or a cautionary tale:

- Scope of MSB shutdowns or penalties. If a significant number of Somali-serving MSBs are shut down or heavily fined, watch for a sharp rise in informal money transfer methods, which could make oversight harder, not easier.

- Congressional investigations and partisan escalation. The House Oversight Committee’s probe into “widespread fraud” under Walz’s watch will likely amplify partisan narratives. Expect hearings that juxtapose this case with pandemic fraud elsewhere, raising questions about selective enforcement.

- Regulatory reforms to social service programs. The real test of seriousness is whether Congress and federal agencies re-engineer grant and monitoring systems for nutrition, childcare, and similar programs — or whether this remains a one-off scandal used mainly for political messaging.

- Community response and law enforcement partnerships. If Somali community leaders are brought into the process as partners — helping identify bad actors and building trust in reporting mechanisms — the crackdown may strengthen institutions. If they feel targeted and sidelined, mistrust and disengagement may deepen.

The bottom line

The Minnesota fraud crackdown is not just about stolen meal money. It is a live experiment in how far the U.S. is willing to extend financial-surveillance tools into domestic welfare programs, and how it treats communities that sit at the intersection of refugee resettlement, remittances, and national security fears. The decisions Treasury, Congress, and state officials make in the coming months will shape not only how much money is recovered, but how millions of Americans experience the balance between protection from fraud and protection from collective suspicion.

Topics

Editor's Comments

What stands out in the Minnesota case is how quickly the narrative has shifted from program fraud to cultural and security anxieties. The Treasury’s use of a geographic targeting order is defensible on technical grounds — MSBs are a logical chokepoint if you believe fraud proceeds are being moved offshore — but the implementation context matters. Similar or larger amounts of pandemic fraud tied to PPP loans and unemployment insurance did not immediately trigger GTOs or high-profile deployments of Treasury personnel. That asymmetry will fuel perceptions that enforcement intensity is being calibrated not just by financial risk, but by the identity of the communities involved. The real challenge for policymakers is to avoid a familiar trap: using legitimate anger over fraud to justify sweeping, long-lasting constraints on financial access for marginalized groups. If the federal response ends with a handful of convictions, some shuttered MSBs, and campaign soundbites about ‘cleaning up blue states,’ the deeper vulnerabilities in emergency-program design will remain. The harder, less politically gratifying work is building oversight systems that are flexible in crises yet structurally resistant to abuse — and doing so without making entire communities collateral damage.

Like this article? Share it with your friends!

If you find this article interesting, feel free to share it with your friends!

Thank you for your support! Sharing is the greatest encouragement for us.